Eliminate debt, achieve financial freedom

We take care of you so you can take care of others.

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

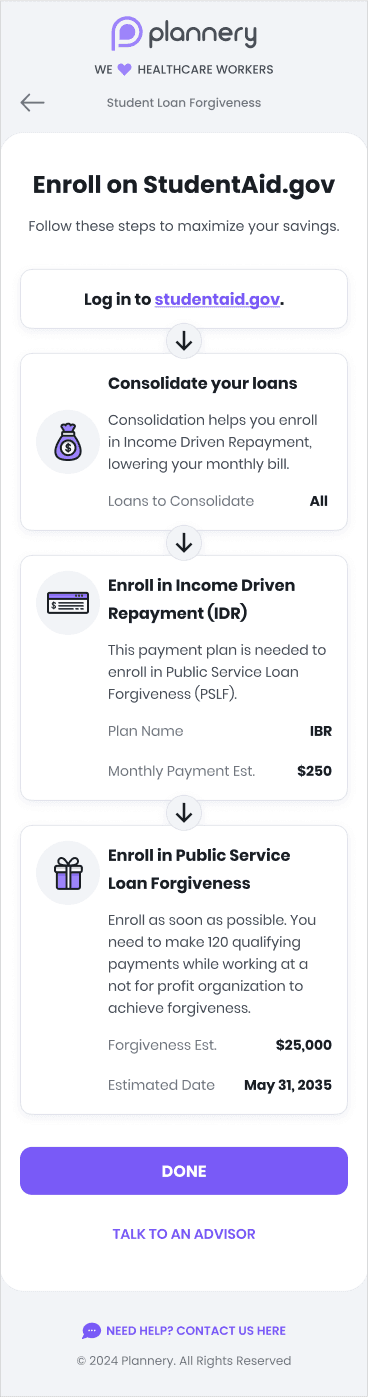

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

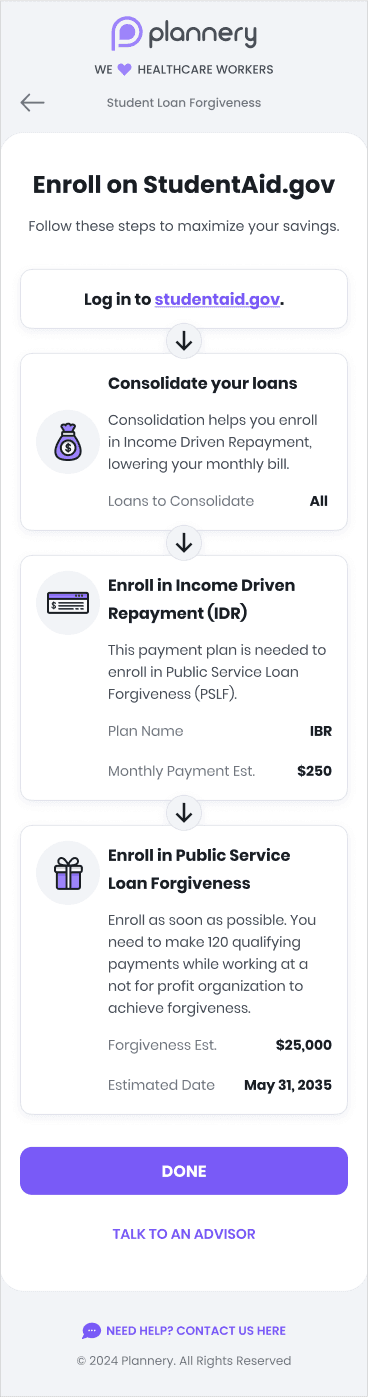

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

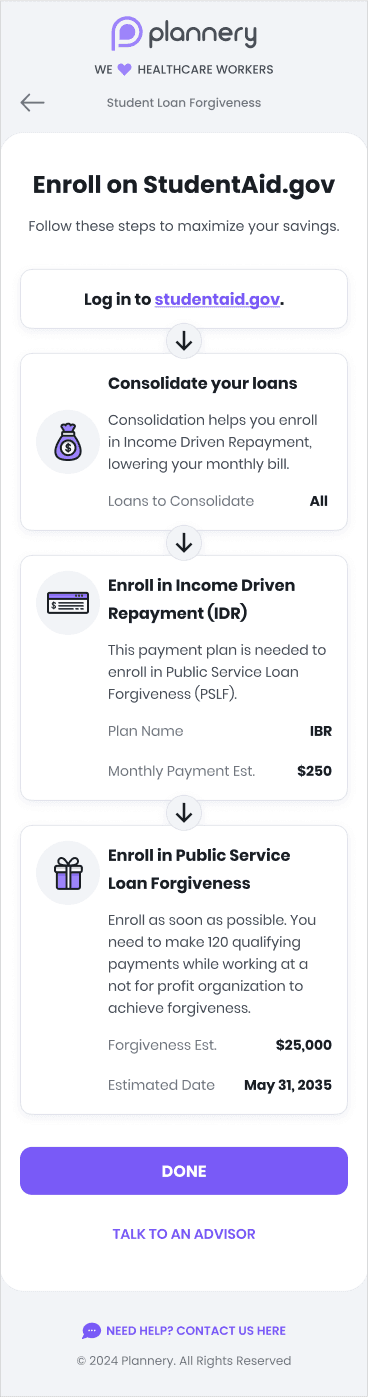

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

Get the first card exclusively for employees

Get the first card exclusively for nurses

Up to

Up to

3

3

points per $1 spent

points per $1 spent

points per $1 spent

250

250

points for every student loan payment

points for every student loan payment

points for every student loan payment

Exclusive access and privileges only for employees

Exclusive access and privileges only for employees

Exclusive access and privileges only for employees

80% less interest

compared to other cards

80% less interest

compared to other cards

80% less interest

compared to other cards

AI powered financial companion pays your card

AI powered financial companion pays your card

AI powered financial companion pays your card

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

The process was super easy. Setup was simple.

I feel way less stressed about the interest I was going to have to pay — Plannery helped me find a lower rate, and that made a big difference. I had no idea what Plannery was, so I called. I’m so glad I did. It turned out to be a low-stress way to start getting out of debt.

Julie, RN

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

The process was super easy. Setup was simple.

I feel way less stressed about the interest I was going to have to pay — Plannery helped me find a lower rate, and that made a big difference. I had no idea what Plannery was, so I called. I’m so glad I did. It turned out to be a low-stress way to start getting out of debt.

Julie, RN

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

The process was super easy. Setup was simple.

I feel way less stressed about the interest I was going to have to pay — Plannery helped me find a lower rate, and that made a big difference. I had no idea what Plannery was, so I called. I’m so glad I did. It turned out to be a low-stress way to start getting out of debt.

Julie, RN

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text

* Based on Q1 2025 LendingTree data for personal loans by credit band. Comparison reflects Plannery’s lowest offered APR by credit tiers versus average APRs on LendingTree’s platform for similar tiers. Actual rates vary by applicant profile and are not guaranteed.

Banking services associated with our services are provided by FinWise Bank, Member FDIC. Your transactions will be processed through an FBO account held by FinWise Bank for the benefit of our customers. We will provide you a monthly summary statement that describes your transactions. Your deposit balances held at FinWise Bank are insured by the Federal Deposit Insurance Corporation (FDIC) for up to the legal limit (currently $250,000 for each category of legal ownership). FinWise Bank supports the program in accordance with applicable law.

* Based on Q1 2025 LendingTree data for personal loans by credit band. Comparison reflects Plannery’s lowest offered APR by credit tiers versus average APRs on LendingTree’s platform for similar tiers. Actual rates vary by applicant profile and are not guaranteed.

Banking services associated with our services are provided by FinWise Bank, Member FDIC. Your transactions will be processed through an FBO account held by FinWise Bank for the benefit of our customers. We will provide you a monthly summary statement that describes your transactions. Your deposit balances held at FinWise Bank are insured by the Federal Deposit Insurance Corporation (FDIC) for up to the legal limit (currently $250,000 for each category of legal ownership). FinWise Bank supports the program in accordance with applicable law.

* Based on Q1 2025 LendingTree data for personal loans by credit band. Comparison reflects Plannery’s lowest offered APR by credit tiers versus average APRs on LendingTree’s platform for similar tiers. Actual rates vary by applicant profile and are not guaranteed.

Banking services associated with our services are provided by FinWise Bank, Member FDIC. Your transactions will be processed through an FBO account held by FinWise Bank for the benefit of our customers. We will provide you a monthly summary statement that describes your transactions. Your deposit balances held at FinWise Bank are insured by the Federal Deposit Insurance Corporation (FDIC) for up to the legal limit (currently $250,000 for each category of legal ownership). FinWise Bank supports the program in accordance with applicable law.